If you're serious about learning how to reduce operational costs, you first have to create a clear financial map of your business. This isn't about glancing at high-level expense reports; it's about digging into the specific activities and workflows that are actually eating up your resources.

Getting this foundational knowledge right is what separates clumsy, short-sighted cuts from strategic, sustainable savings.

Finding Your True Cost Drivers

Before you can start trimming the fat, you need absolute clarity on where your money is going. So many businesses fall into the trap of looking at broad categories like "marketing" or "payroll" without ever understanding the granular activities driving those numbers.

A true cost driver isn't just an expense line on a spreadsheet. It's the operational activity that creates the cost in the first place.

For example, seeing "high shipping costs" is just identifying a symptom. The real cost drivers might be inefficient packing processes that waste materials, a failure to negotiate better rates with carriers, or poor inventory placement that forces expensive long-distance shipments. Pinpointing these root causes is the real first step.

Categorize Every Single Expense

Start by breaking down every operational expense. And I mean every single one. But don't just list them—you need to connect each one to a specific business function. This is how you turn abstract numbers into a tangible, actionable map of your operations.

Your categories will likely fall into a few key buckets:

- Direct Costs: Think raw materials, direct labor, and manufacturing supplies—anything tied directly to producing your goods or services.

- Indirect Costs (Overhead): These are the expenses that keep the lights on but aren't tied to a specific product. This includes rent, utilities, and administrative salaries.

- Variable Costs: Expenses that go up or down with business activity, like shipping fees or sales commissions.

- Fixed Costs: The consistent, predictable bills that don't change much month-to-month, like your software subscriptions, insurance, and loan payments.

A huge blind spot I see all the time is "maverick spending"—those unauthorized purchases made outside of approved vendors or processes. A detailed expense audit almost always uncovers these hidden costs, often revealing massive opportunities for immediate savings just by consolidating vendors or enforcing procurement policies.

Connecting Costs to Your Operations

Once everything is categorized, the real work begins: linking those costs to the processes that generate them.

If your software subscription costs are creeping up, which departments are using which tools? Are you paying for redundant applications that do the same thing? If your utility bills are a major concern, which specific machinery or operational hours are the primary culprits? For businesses with logistical arms, exploring comprehensive fleet cost-saving strategies can be a goldmine for identifying where savings can be made.

This analysis gives you the crucial context you need to make smart, targeted decisions. Instead of a panicked, across-the-board spending freeze, you can zero in on the specific areas where changes will deliver the biggest impact. This foundational understanding sets the stage for everything that follows—from process optimization to strategic automation.

Driving Efficiency with Process Optimization

Once you've pinpointed your biggest cost drivers, it's time to zoom in on your day-to-day operations. Inefficient workflows are the quiet thieves of profitability. They creep into your business disguised as "the way we've always done things," slowly draining resources through wasted time, repetitive tasks, and unnecessary steps.

Learning how to systematically find and fix this waste is the key to reducing operational costs for good.

This is where methodologies like Lean and Kaizen come in handy. Don’t let the names intimidate you; at their core, they’re about one simple idea: maximizing value by minimizing waste. It all starts with mapping out your current processes, step by step, to find those hidden bottlenecks and time-sucks that have become part of the furniture.

For example, something as simple as adopting paperless work orders can have a huge ripple effect, cutting printing costs, slashing administrative errors, and getting invoices paid faster.

Conducting a Process Audit

A process audit isn't some complex, formal procedure. It’s just a structured way of looking at how work actually gets done in your organization. The goal is to draw a map of a workflow—from start to finish—to see exactly where things can be improved.

Start small. Pick one key process, maybe one you already identified as a major cost driver. This could be anything from onboarding a new client to fulfilling a customer order.

Here’s a practical way to approach it:

- Map Every Single Step: Write down each action, decision, and handoff. Seriously, don't leave anything out, no matter how tiny it seems.

- Identify the Bottlenecks: Where does work get stuck? What steps cause the longest delays? These are your prime targets.

- Hunt for Redundant Tasks: Look for duplicated effort. Are multiple people entering the same data into different systems? Are you running checks that are no longer needed?

- Eliminate Non-Value-Adding Activities: Be ruthless here. If a step doesn't directly improve the final product or the customer's experience, ask why it exists.

This audit gives you a clear blueprint for what needs to be fixed. Maybe a clunky, multi-layered approval chain can be simplified. Or perhaps an entire manual step can be automated away completely. Uncovering these insights is how you start building leaner, more cost-effective operations.

Embedding Continuous Improvement

One-time fixes feel great, but they're just a band-aid. Lasting results come from building a culture of continuous improvement. This means you empower your team to constantly look for and solve small inefficiencies themselves.

When your employees are encouraged to suggest improvements, cost reduction becomes a team sport instead of a top-down mandate.

This approach is most powerful when it blends process tweaks with smart technology. A survey of executives found that about 60% plan to combine these strategies to improve their margins. By mixing proven methods like Lean with automation and smart restructuring, companies can simplify hierarchies, get rid of duplicated work, and become much more agile.

Key Takeaway: The goal isn't just to cut costs once. It's to build a resilient system where efficiency is part of your company's DNA. Simple shifts, like clarifying roles or flattening communication channels, can have a massive impact on productivity.

Making your business more efficient is a direct path to growth. When you get rid of operational friction, you free up cash and talent that can be put to work on things that actually move the needle. For a deeper look at this, check out our guide on how to improve business efficiency and boost growth. The principles are the same whether you're a small online store or a massive enterprise.

Leveraging Automation and Strategic Outsourcing

Let's talk about two of the heaviest hitters in cost reduction: automation and smart outsourcing. When you get these right, they don't just trim expenses; they free up your team to do what they do best—innovate and grow the business. This isn't about replacing people. It's about giving them superpowers.

By handing over repetitive, soul-crushing tasks to software and letting specialized partners handle non-core functions, you reclaim your team's most valuable asset: their time. This one-two punch creates a much leaner, more resilient operation.

Automating for Efficiency and Accuracy

Automation is the quickest way to cut operational fat. Think about all those little manual tasks that eat up hours every week. Data entry, report generation, invoice processing—these are perfect candidates for automation, especially with today's accessible AI and Robotic Process Automation (RPA) tools.

I've seen it work wonders in just about every department:

- Finance & Accounting: Imagine closing the books faster with fewer errors because invoicing and expense approvals happen automatically. It's a game-changer.

- Human Resources: Onboarding new hires can be a mountain of paperwork. Automating it means your HR team can focus on people, not paper.

- Customer Support: So many support tickets are the same questions over and over. "Where's my order?" "What are your hours?" AI agents can handle these instantly, 24/7, leaving your human experts for the tough cases that need a real conversation.

A great real-world example is an e-commerce store I worked with. They set up a simple AI to answer order status questions. Customer satisfaction went up, and their support team was freed up to handle complex returns and product issues, which dramatically improved loyalty. You can find more practical business process automation examples to boost efficiency in 2025 that you could apply tomorrow.

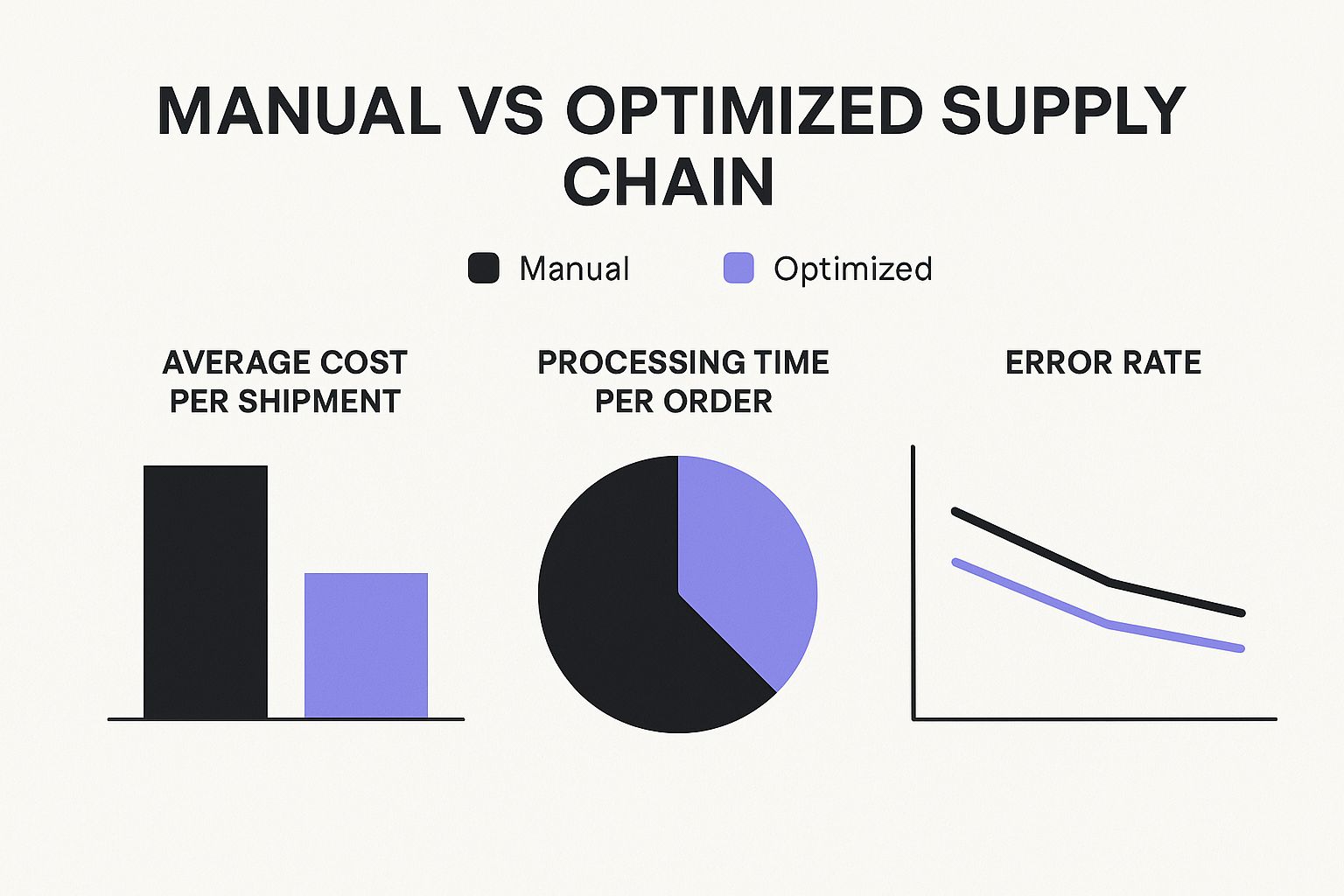

This isn't just theory. The data below shows what happens when you optimize just one part of the business—the supply chain—by moving from manual processes to an automated system.

The numbers speak for themselves. Lower shipment costs, faster processing, and a near-elimination of errors. That's money straight back into your pocket and happier customers.

Deciding What to Outsource

While automation is for internal tasks, outsourcing is for entire business functions. The key here is to be strategic. You want to offload non-core activities—the stuff that needs to get done but isn't what your customers pay you for. Handing these functions over to a specialist often means they get done better, faster, and cheaper.

Not sure what qualifies? Ask yourself these three simple questions:

- Is this activity a key reason customers choose us over competitors?

- Is there another company out there that does only this, and does it really well?

- If we outsourced this, would our team have more time for high-impact work?

If you answered "no" to the first and "yes" to the other two, you've found a prime candidate for outsourcing. Common examples are things like IT support, payroll, bookkeeping, and digital marketing campaigns.

Combining these two approaches—automation for tasks and outsourcing for functions—is a powerful strategy for staying lean and competitive.

Cost Reduction Impact: Automation vs. Outsourcing

When deciding between investing in automation tools or outsourcing a function, it helps to see a direct comparison. Each has its sweet spot.

| Strategy | Potential Cost Reduction | Primary Applications | Key Benefit |

|---|---|---|---|

| Automation | 15-40% | Repetitive, rule-based tasks (data entry, report generation, basic customer queries) | Increased internal efficiency and accuracy |

| Outsourcing | 20-60% | Non-core business functions (IT, payroll, accounting, specialized marketing) | Access to specialized expertise and lower labor costs |

Ultimately, automation improves how your team works, while outsourcing changes who does the work. Many of the most efficient companies I've seen use a blend of both.

Choosing the Right Partner

I can't stress this enough: a bad outsourcing partnership is worse than no partnership at all. It will cost you more time, money, and headaches than you were trying to save.

Your selection process has to be rigorous. For technical functions, a solid guide on choosing a Managed Service Provider can be invaluable. Don't just look at the price tag; create a scorecard to vet potential partners properly.

Here's what should be on it:

- Proven Expertise: Don't just take their word for it. Ask for case studies and references from companies like yours.

- Scalability: Can they grow with you? Or will you be looking for a new partner in a year? Make sure the contract is flexible.

- Security & Compliance: This is non-negotiable. How do they protect your data? Do they meet the compliance standards for your industry (like GDPR or HIPAA)?

- Culture & Communication: You'll be working closely with these people. Do they communicate clearly? Do their values align with yours? A mismatch here can cause constant friction.

Take your time with this step. Get everything in writing with a clear Service Level Agreement (SLA). A little due diligence upfront will save you from a world of trouble down the road and ensure you actually get the cost savings you're looking for.

Unlocking Savings Through Strategic Procurement

Your procurement process is one of the most significant—and most overlooked—areas for deep operational cost savings. I’ve seen it time and again: businesses get stuck in a tactical loop, simply chasing the lowest price for every single purchase. That approach leaves a massive amount of money on the table.

To really get a handle on operational costs, you need to shift from basic purchasing to strategic procurement. This is about transforming your buying function from a reactive cost center into a proactive driver of both profitability and efficiency. It’s about being smarter, not just cheaper.

The core of this strategy is to analyze what you buy, who you buy it from, and how you buy it. Once you move beyond one-off transactions and look at the bigger picture, you can unlock leverage you never even knew you had.

Embrace Category Management

First things first: stop thinking about purchases individually. Start grouping them. This is the heart of category management. You analyze all your spending and bundle similar products or services into logical categories.

For example, instead of treating every software license as its own separate purchase, you create a "Software" category. Instead of buying marketing services from a dozen different freelancers, you create a "Marketing Services" category. It’s a simple change in perspective with powerful results.

Common categories often include:

- IT & Technology (hardware, software licenses, cloud services)

- Professional Services (legal, accounting, consulting)

- Marketing & Advertising (agencies, ad spend, content creation)

- Office Supplies & Equipment

- Travel & Entertainment

By grouping related purchases, you get a bird's-eye view of your total spend in that area. This visibility is the foundation for a much smarter, unified buying strategy for each category, rather than just making isolated and often inefficient decisions.

This disciplined approach is incredibly effective. I’ve seen companies using category management slash costs by 10-15% by improving supplier relationships and finally making data-driven decisions. The strategy lets you consolidate spending, standardize what you buy, and leverage economies of scale—turning procurement into a genuine strategic partner.

Consolidate Spending and Suppliers

Once you’ve defined your categories, you’ll probably uncover a classic symptom of inefficient buying: supplier sprawl. This happens when you have dozens, maybe even hundreds, of different vendors supplying similar things, often at wildly different prices and terms.

This is where you can gain immense power. By consolidating your spending for an entire category with a smaller, curated list of strategic suppliers, you hit two critical goals at once:

- Massive Negotiation Leverage: Walking up to one or two key suppliers with the promise of your entire business volume for a category gives you incredible bargaining power. You can negotiate much better pricing, more favorable payment terms, and improved service levels.

- Reduced Administrative Overhead: Managing relationships with 50 suppliers is a nightmare compared to managing five. Consolidation simplifies everything—invoicing, payments, contract management, and performance reviews.

This strategy works especially well for indirect spending—the goods and services not directly tied to your final product. These areas, like office supplies or facilities management, are often where uncontrolled "maverick spending" runs rampant. Centralizing these purchases brings immediate control and savings. For support teams specifically, managing vendor relationships for tools and services is a key area for savings, as detailed in these proven cost reduction strategies for support teams.

Build Strategic Supplier Partnerships

The point of consolidating suppliers isn't just to squeeze them on price. It's about building stronger, more collaborative partnerships with the ones who truly add value to your business.

Think of your key suppliers not as adversaries in a negotiation, but as extensions of your own team. When you have a genuine partnership, you can work together on long-term goals that benefit everyone.

A true partner might:

- Proactively suggest more cost-effective product alternatives.

- Offer you early access to new technology or innovations.

- Work with you to streamline the supply chain, which reduces your inventory carrying costs.

- Provide valuable market insights that help your business stay ahead.

This collaborative approach moves the relationship beyond price and into a discussion about total value. The savings you generate from these kinds of partnerships often far exceed what you could achieve through aggressive, short-term tactics alone. It secures your supply chain, reduces risk, and fosters mutual growth, turning procurement into a sustainable competitive advantage.

Building a Lasting Cost-Conscious Culture

One-off budget cuts are like putting a bandage on a deep wound—they're temporary fixes that don't solve the underlying problem. The real, sustainable savings that truly change a business come from a much deeper cultural shift. It’s about moving from seeing cost reduction as a one-time project to embedding smart financial discipline into your company's very DNA.

The goal here isn't to create a culture of fear where people are afraid to spend a dime. It's to build a proactive team where every single person understands their role in the company's financial health and feels empowered to contribute to its long-term success.

Moving Beyond Top-Down Mandates

Let's be honest: true cost-consciousness isn't dictated from the C-suite. It has to grow from the ground up. When employees feel like cost-cutting is something being done to them, they'll disengage. The only way it works is by making smart spending a shared responsibility.

This all starts with open and honest communication. Share the company's financial goals with the entire team. You have to explain the why—that managing expenses isn't just about profit margins, but about securing jobs, funding innovation, and fueling real growth.

When people get the big picture, they stop being bystanders and start acting like partners in the mission. Transparency turns abstract financial targets into a tangible, collective goal.

Fostering Employee-Led Innovation

Your frontline employees are the real experts in their own workflows. They see the small, daily inefficiencies and frustrations that managers and executives will never notice. A leaky faucet, a redundant software license, a wasteful process—they see it all. Your job is to create a system that captures and rewards their insights.

Don't just casually ask for ideas. Build a formal program to encourage them.

- Launch a Cost-Saving Idea Program: Create a dead-simple channel where anyone can submit an idea. This could be a dedicated Slack channel, a simple form, or even a suggestion box. The key is to make it easy and accessible.

- Offer Meaningful Incentives: Reward ideas that get implemented. This doesn't always mean a huge cash bonus. It could be a percentage of the first year's savings, public recognition in a company-wide meeting, extra PTO, or a budget for professional development.

- Provide Feedback on Every Single Idea: This is critical. Even if an idea isn't implemented, acknowledge the effort and explain the reasoning. It shows you value every contribution and keeps people engaged and thinking creatively.

I once saw a warehouse worker suggest a tiny change in how they applied packing tape. It seemed minor, but it saved the company over $25,000 a year in materials and time. That idea would have never surfaced without a program designed to listen.

Making Progress Visible and Celebrating Wins

What gets measured gets managed. To keep the momentum going, you have to track your progress with clear, simple metrics and—most importantly—celebrate your collective wins along the way.

The most powerful motivator isn't just the saving itself, but the shared sense of accomplishment. When the team sees their small, daily efforts adding up to significant financial wins for the company, the culture of cost-consciousness becomes self-reinforcing.

Create a dashboard that tracks KPIs everyone can understand. Skip the complex accounting jargon.

Focus on simple, tangible metrics like these:

| KPI Category | Example Metric | What It Measures |

|---|---|---|

| Utility Usage | Electricity Cost per Square Foot | Efficiency of building operations and energy consumption habits. |

| Supply Costs | Office Supplies Spend per Employee | Awareness of waste and effectiveness of procurement policies. |

| Process Efficiency | Cost per Invoice Processed | Impact of automation and process improvements in finance. |

| Vendor Management | Spend with Preferred Suppliers | Success of supplier consolidation and strategic sourcing efforts. |

When you hit a milestone—like reducing departmental supply costs by 15% or eliminating a few redundant software subscriptions—celebrate it. Announce it at the all-hands meeting. Treat the team responsible to lunch. Public praise reinforces the behavior you want to see and proves that smart financial management is a core company value.

This is how you transform reducing operational costs from a dreaded chore into a team sport that everyone wants to win.

Got Questions About Cutting Operational Costs? We've Got Answers.

When business leaders start looking for ways to boost efficiency and trim the fat, the same questions pop up time and time again. We've heard them all. Here are some direct, no-fluff answers to the most common ones.

What’s the Very First Thing I Should Do?

Before you do anything else, you need to conduct a thorough expense audit. I can't stress this enough. You can't make smart cuts or strategic changes until you know exactly where every single dollar is going—on a granular level.

This isn't about looking at the high-level categories in your accounting software. You need to dig deeper. Analyze spending by department, by project, and even by individual vendor. This is the only way you'll spot your biggest cost centers, identify non-essential spending, and uncover those sneaky, hidden inefficiencies that bleed your budget dry. Think of it as the foundation for every other cost-saving move you'll make.

How Can I Reduce Costs Without Laying People Off?

This is a huge—and very valid—concern for most leaders. The good news is, the best strategies focus on efficiency and technology, not just headcount. The real goal is to empower your existing team and make them more productive.

Here are a few proven ways to do just that:

- Automate the Repetitive Stuff: Use software and AI agents to handle the mind-numbing, rule-based tasks. Think data entry, answering basic customer questions, or pulling standard reports. This frees up your team for the high-value, strategic work that actually requires a human brain.

- Optimize Your Core Workflows: Get a whiteboard and map out your key business processes from start to finish. Hunt for the bottlenecks, the redundant steps, and the unnecessary handoffs between people or teams. Simply untangling how work gets done can massively increase output without adding a single person to the payroll.

- Renegotiate and Consolidate: Get on the phone with your suppliers. You'd be amazed at the savings you can find just by renegotiating contracts for software, services, and materials. Also, by consolidating your spending with fewer, more strategic vendors, you gain a ton of leverage to ask for better rates.

Here's the key insight: investing in your team's efficiency is often the most profitable investment you can make. When you eliminate tedious work, you don't just cut hidden labor costs—you also boost morale and retention, which pays its own dividends down the line.

Where Are the Biggest Cost-Saving Opportunities Usually Hiding?

While every company is different, our experience shows that three areas almost always offer the biggest bang for your buck. If you're wondering where to start, point your flashlight here first.

- Procurement and Vendor Management: This is classic low-hanging fruit. Getting serious about strategic sourcing, consolidating suppliers to get more negotiating power, and cracking down on unauthorized "maverick spending" can deliver immediate wins on your direct costs.

- Your Technology and Software Stack: So many companies are paying for redundant software, licenses that nobody uses, or services that are just plain overpriced. A full audit of your tech stack can uncover huge savings by cutting out overlap or switching to more cost-effective tools.

- Manual Business Processes: Any task that involves a person manually moving information from one system to another is a prime target. Automating these soul-crushing workflows in departments like finance, HR, or customer support always delivers a strong and lasting return.

How Do I Actually Know if a Cost-Cutting Measure Is Working?

Success isn't just watching an expense line on a spreadsheet go down. Real success means you've cut costs without hurting quality, tanking employee morale, or annoying your customers. It's crucial to track both financial and operational metrics side-by-side.

Before you make a change, set clear Key Performance Indicators (KPIs). For instance, if you decide to automate a customer support process, you need to track:

- Financial Metric: The reduction in your cost-per-contact.

- Operational Metric: Customer Satisfaction (CSAT) scores and first-contact resolution rates.

If your cost-per-contact drops but your CSAT score plummets, that's not a win. That's a fail. A truly successful measure improves your bottom line while maintaining or even improving performance. It's about becoming more efficient, not just cheaper. This balanced view is the only way to ensure your cost-reduction efforts are sustainable and good for the business as a whole.

Are you spending too much time and money answering the same customer questions over and over? FlowGent AI deploys intelligent AI agents across your website, WhatsApp, and other channels to provide instant, 24/7 support. Our no-code platform helps you cut support costs by up to 70% and free up your team for high-impact work.